China's EV and Hybrid Sales Reach Record Highs

China's EV Market Soars: A Prescription for a Greener Future

Electrifying Surge in China's Automarket

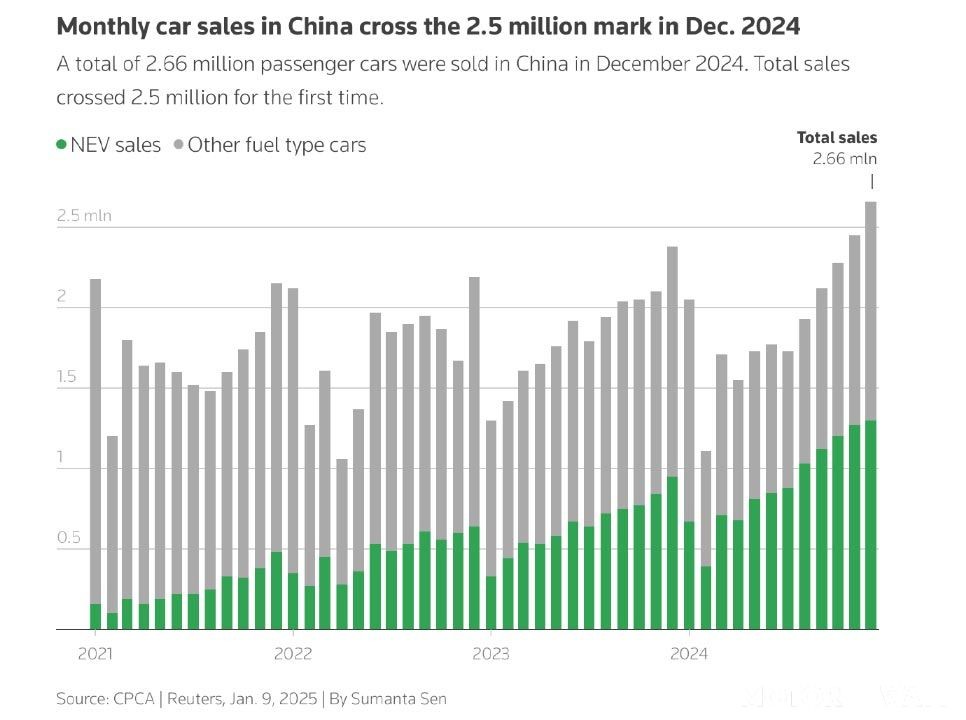

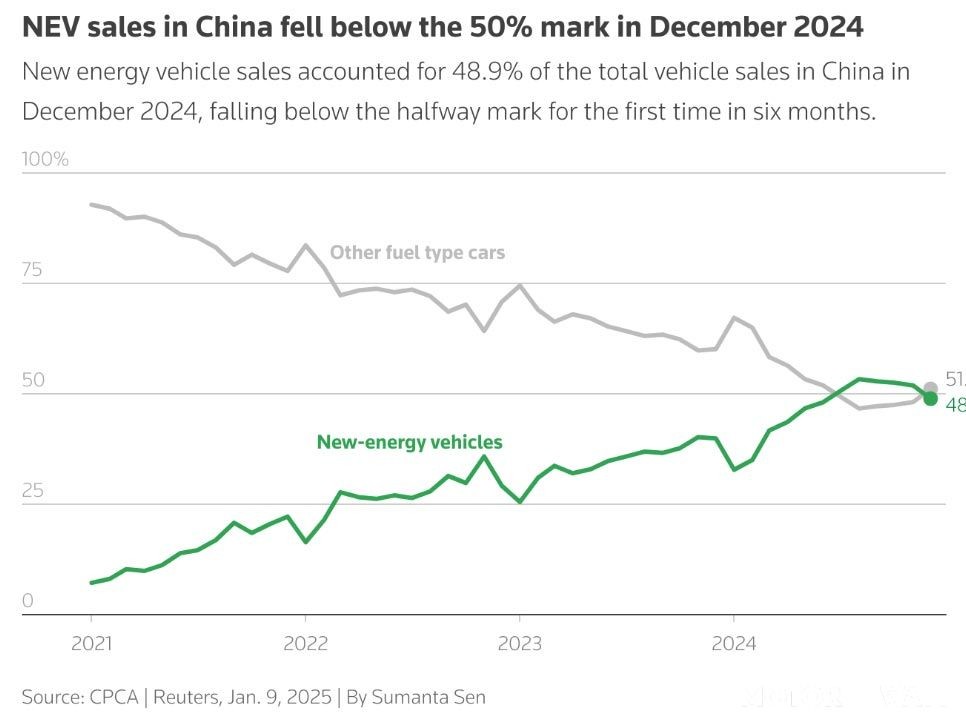

China's automotive landscape is buzzing with electrifying excitement. In 2024, the sale of new energy vehicles (NEVs) surged by a whopping 40.7%, taking up a notable 47.2% of all passenger car sales. Fueled by aggressive price strategies and government incentives, local brands like BYD, Geely, and Xiaomi made significant gains, outpacing their foreign counterparts.

Navigating the International Terrain

China's dominance in auto exports might see a slowdown this year. The China Passenger Car Association (CPCA) revealed a sharp spike in car exports by 25% in 2024, reaching 4.8 million units. But with tariffs stamping their mark, especially from the EU, growth might plateau. Still, China held its champion title as the largest auto exporter for two consecutive years, keeping Japan in its rearview mirror.

Government Support Fuels the Fire

The roaring success of NEVs is part and parcel of the government's support. A staggering $2,800 subsidy for NEVs and around $2,000 for efficiently-fueled combustion engines have further bolstered the sector. More than 6.6 million vehicles reaped these benefits last year. And with subsidies extended into 2025, consumers have more reason to go green.

The Road Ahead Beyond China

While China's NEVs are gaining traction globally, the scene in Europe is different due to recent tariffs. However, establishing production bases in Europe, like BYD's facility in Hungary, could be a game-changer in the long haul, ensuring a solid footing in the European market.

Local Heroes on a Roll

In China's domestic market, the world's largest, car sales maintained their growth pace in 2024 as EV and plug-in hybrid sales hit a record high amid a brutal price war and with subsidised trade-ins for greener vehicles driving demand.

The outstanding growth in China in a largely stalling global EV landscape bode well for local leaders such as BYD, opens new tab, , Geely and Xiaomi, opens new tab and expedited an industry shakeout in a competitive market.

Challenges Lurk in the Shadows

Despite these triumphs, challenges are apparent. Profit margins have thinned, falling to 4.4% in the first eleven months of 2024, compared to 5% in 2023. The fierce price wars have compelled suppliers and dealers to make hard choices—cutting prices or offering steeper discounts.

The Ripple Effect

China's domestic car sales are on an upward trajectory, with 23.1 million units sold in 2024, marking a 5.3% increase. As new energy vehicle sales close in on the 50% threshold, an encouraging "cash-for-clunkers" style program further amplifies demand.

Pioneers in Transition

While traditional auto powerhouses like General Motors, Toyota, and VOLKSWAGEN grapple with maintaining momentum in China, local brands, backed by favorable policies, continue to grow their stronghold.

Forecast: A Green Horizon

In 2025, China's car sales are anticipated to climb another 2%, with NEVs projected to comprise 57% of the total. Analysts, eyeing a potential uplift of 3 million units from trade-in subsidies, foresee sustained growth in the world's largest automotive market, even as profitability remains a concern.

Comments